Fees

A

First Dollar

First Dollar was founded in 2019 by a successful repeat team of entrepreneurs who previously built and sold a care management company to athenahealth, one of the leading medical billing and EHR companies. First Dollar is backed by $5M in venture funding, is headquartered in Austin, TX and has been servicing health savings accounts (HSAs) for one year. First Dollar is available for individuals and employers.

First Dollar is the first HSA that puts consumers first. From fee-free savings, best-in-class investing, and curated discounts on popular health care needs. No HSA does more to save consumers money.

First Dollar is built around three central pillars:

To help consumers save. First Dollar’s HSA is 100% fee-free and triple-tax advantaged. Members can deposit money pre-tax, watch savings grow tax-free, and can spend on qualified expenses tax-free.

To help consumers spend. They’ve curated popular health care needs under the deductible. Members can save up to 85% off on prescriptions, get 20% off at-home lab tests, and take advantage of built-in receipt management tools. Built-in receipt management helps you keep track of expenses for reimbursement now or in the future.

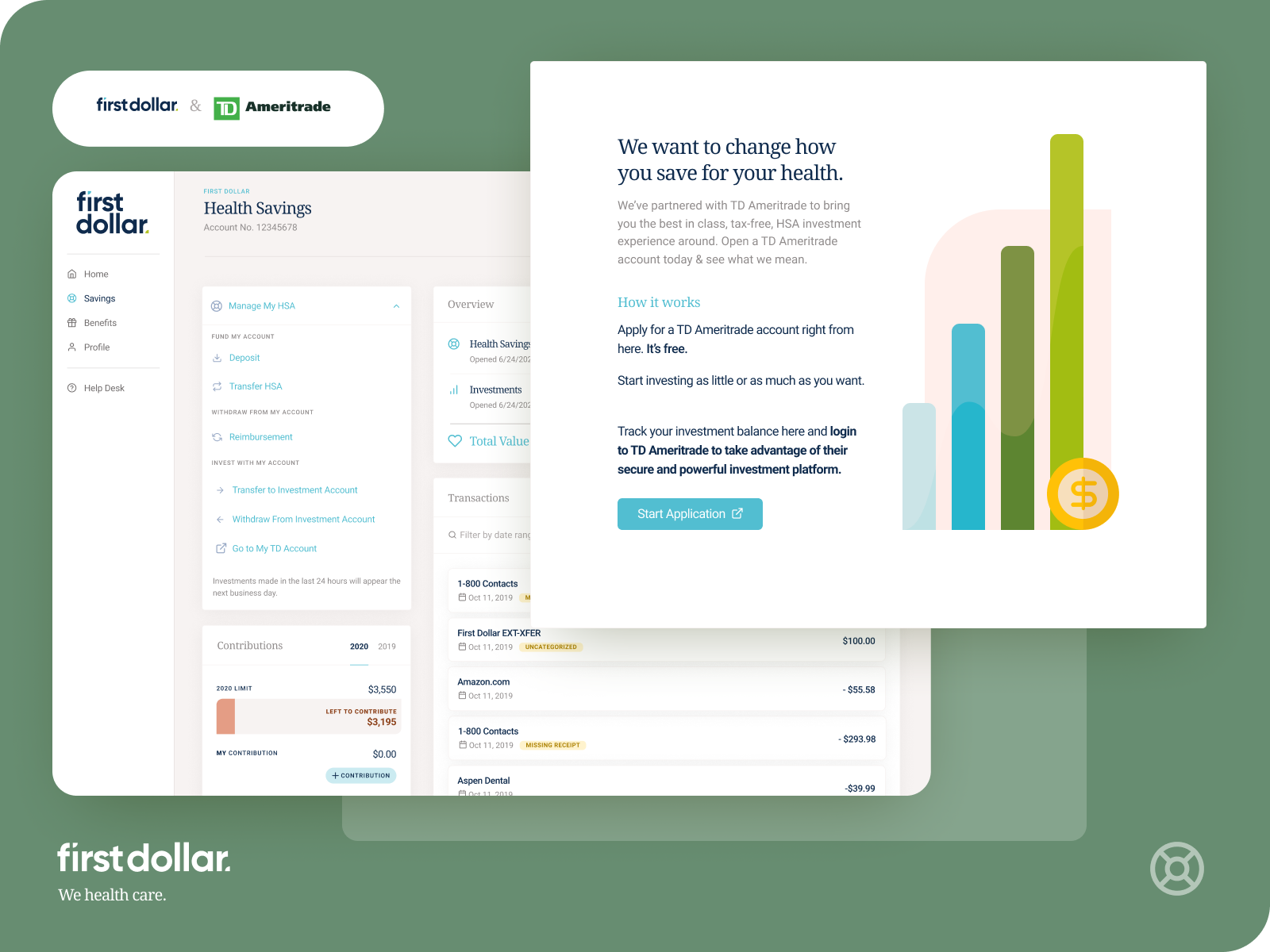

To help consumers invest. First Dollar has partnered with TD Ameritrade to bring members best-in-class, fee-free investing. Members can access 3,000+ stocks, mutual funds, and ETFs, and enjoy tax-free growth of their HSA.

Fees

A

Fund Access

B+

Features

B+

Value Added

B+

Overall

A-

The best HSAs for spenders are characterized by low maintenance fees. First Dollar does not charge a monthly maintenance fee.

The best HSAs for spenders also have very few behavioral fees. Behavioral fees are not recurring in nature, but can be incurred by the account holder when a certain action is executed. First Dollar’s fee schedule has a moderate amount of behavioral fees. In most cases, First Dollar HSA users will never incur these fees.

Below we have reconstructed First Dollar’s fee schedule to exhibit fees spenders are most likely to encounter.

1 No paper statements. Free electronic statements

2 Daily overdraft fee begins on the 5th calendar day after first overdraft item and continues for 30 calendar days if the account remains in a negative balance.

3 First 3 cards are free

In the chart below you can compare First Dollar’s fees to its competitors.

Healthcare products are traditionally built to serve the healthcare industry. First Dollar is building the first one that serves people. Their goal is to help people think about how to save and plan for a healthy, happy life. The First Dollar team believes that for every $1 you put into your First Dollar HSA, you should get $2 in value back in savings and spending. They are of the belief that a great HSA is useful. In that spirit, First Dollar is creating an ecosystem that helps consumers save intelligently and find the right products and services at fair prices.

Negotiated Discounts

First Dollar has partnered with companies that offer discounted prices for lab tests, medications and practitioners.

EverlyWell offers access to laboratory testing for wellness monitoring, informational and educational use. Their 30+ at-home tests offer simple sample collection, free shipping, and physician-reviewed results and insights sent to your device in just days. First Dollar users can save 20% off of at-home lab testing via Everlywell.

RxSaver, formerly known as LowestMed.com, is a free discount prescription finder that can help you save money on medications no matter where you shop. RxSaver is a website and mobile app that makes comparison shopping for medication simple. Just enter the name and dosage of your medication along with your ZIP code, and RxSaver will display a list of current prices at pharmacies in your area.

First Dollar joined forces with RxSaver to launch an HSA debit card. The first-of-its-kind, First Dollar's HSA debit card has RxSaver's network information inscribed onto the back, making it easy for customers to save up to 85% on prescriptions by simply flashing their HSA card at checkout.

Health Concierge

When you, your spouse, and your dependents have qualified medical expenses that aren’t covered by your health care plan, you can use your HSA money tax-free to pay for them. There are multiple ways you can spend from your HSA.

First Dollar allows participants to pay for qualified medical expenses with a debit card. At this time bill pay is not available, but we expect this to change in the near future. Checks are not available.

Bill Pay

Bill Pay |

(✗) |

Debit Card + Apple & Google Wallet

Debit Card + Apple & Google Wallet |

(✓) |

Checks

Checks |

(✗) |

You can pay for qualified medical expenses out-of-pocket and reimburse yourself anytime using your HSA money. As long as you opened your HSA before the expense was incurred, your reimbursement will be tax-free.

When you pay for qualified medical expenses out-of-pocket, you should be able to access your HSA dollars multiple ways whether it be via online transfers, check disbursements, or ATM withdrawals.

Generally speaking, the best way to reimburse yourself is with electronic funds transfers (EFTs) that are processed through the Automated Clearing House (ACH) network. EFTs are easy, speedy, cost-effective, paperless, safe and secure.

ACH Bank Transfers

ACH Bank Transfers |

(✓) |

ATM Withdrawal

ATM Withdrawal |

(✗) |

Checks

Checks |

(✗) |

First Dollar participants can reimburse themselves via ACH bank transfers. No ATM withdrawals allowed. No check reimbursements either.

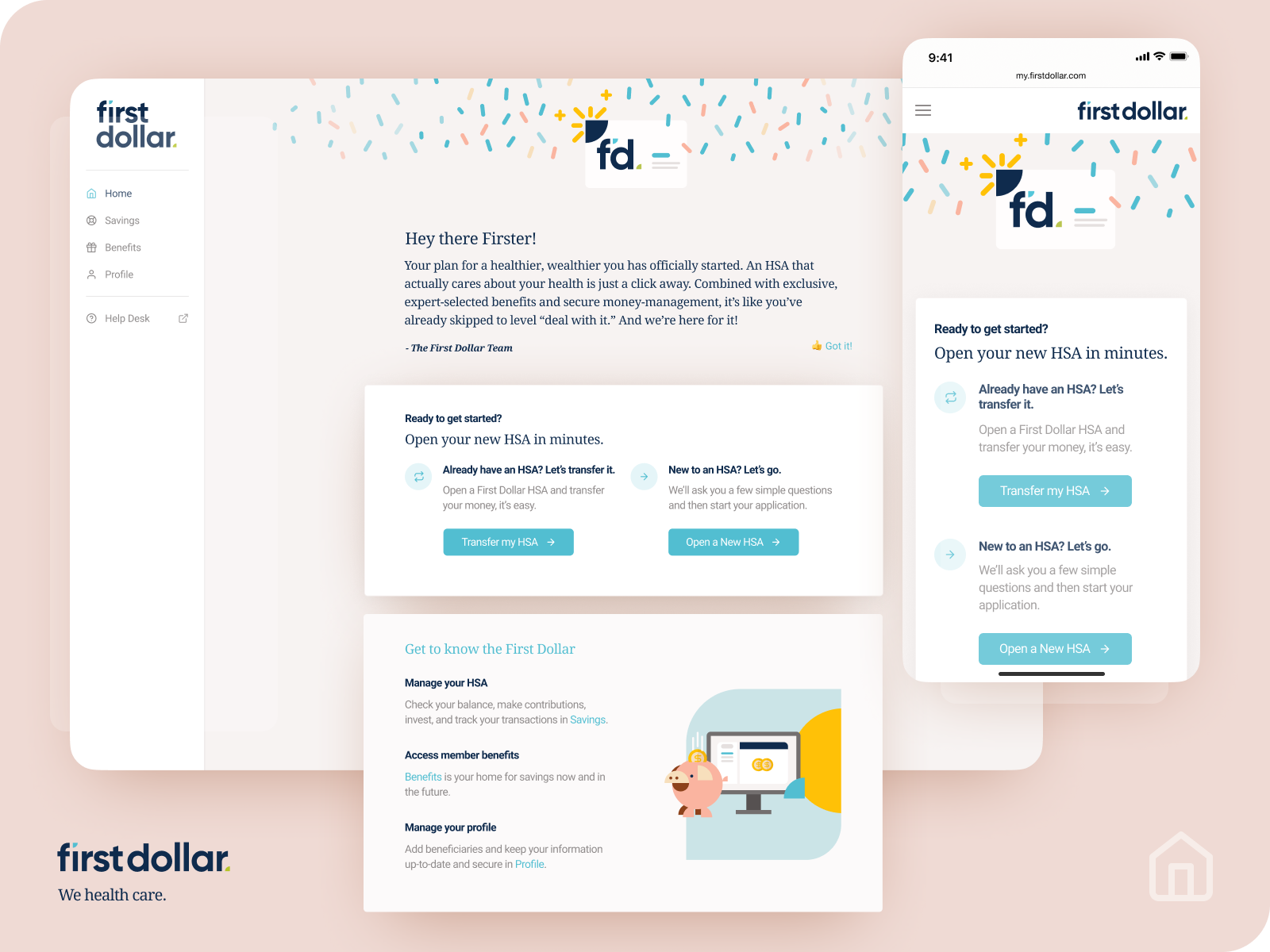

Beautiful Platform

First Dollar has built a modern HSA platform with all the bells and whistles. The platform looks nice and is user-friendly. Signing up is a cinch. Administration is simple and intuitive. Contribution management is hassle-free. Generally speaking, everything one needs to access is a single click away.

Below we have included a few screenshots of First Dollar’s beautifully designed and intuitive platform.

Document Storage

Receipt and documentation is integrated into every transaction today. Their roadmap includes a Receipt Vault for queuing up future reimbursements.

Education & Resources

First Dollar includes educational content through the website, help center articles, email campaigns, videos and social media, and conversational bots.

First Dollar has also spent a lot of time putting together (and growing) their resource center. This is an area specifically designed for anyone who is interested in learning more about HSAs. First Dollar wants to help demystify the HSA and the make it clear how powerful of a utility it is.

Customer Service

First Dollar Agents are on call or chat Mon - Fri from 8am - 5pm CT.

Forms of communication

Interactive Voice Response

Chat (+Bots)

Voice

Video conferencing

First Dollar also author’s and updates 100’s of articles so their customers can find answers, quickly. The end goal is to empower customers to solve problems faster than they can.

Claims Integration

This feature is not available at this time. First Dollar does not directly import a participant’s insurance information.

Mobil App

The First Dollar web app is responsive and optimized for mobile. A mobile app is not available at this time, but a native app is on their roadmap.

Participants looking for a fee-free, feature rich HSA offering. No monthly recurring fees.

Those who are comfortable with online-only HSA management.

Dual-purpose use (spender/investor). First Dollar also offers a TD Ameritrade brokerage account for investors.

Those with a family HSA.

Those who understand that First Dollar is a startup.

sign up at www.firstdollar.com in 3 minutes.